52+ can i use tax transcript instead of w2 for mortgage

Web Here is the skinny. Applying for a home loan without a W-2 may require more paperwork but is not impossible.

Mortgage Applicants Beware Audit Says Irs Tax Transcript Program Lacks Adequate Security Protections The Washington Post

Web Yes but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return.

. Transcript You can get a wage and income transcript. IRS Forms W-2 1099 and 1098. FHA VA loans no longer require a full tax transcript 4506-T to be done if.

Learn How Simple Filing Taxes Can Be. Yes you can use the wage and income transcript that shows your wages and federal withholding. Web Can I use tax transcript instead of w2 for mortgage.

Visit our Get Transcript frequently asked questions. Enter Your Employers EIN Follow the Steps to Import Your W-2. Web Published on April 9 2019 under First-Time Home Buyers.

Dont Leave Money On The Table with HR Block. Current tax year information may not be complete until July. Get Your Max Refund Guaranteed.

Web You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. You can use the transript to PAPER file the return but it cannot be efiled since the transcript doesnt have the employers EIN on it and it has no. This transcript is available for up to 10 prior years.

If you want to buy a house these are vital pieces of info all lending companies will need for you to be pre. TurboTax Makes It Easy To Get Your W-2 Forms Done Right. Web Do not need tax transcripts 1040s for FHA VA loans if you are a W-2 employee.

Web For example. This answer does not create an attorney-client relationship. Web You can get a wage and income transcript from the IRS.

Web Reveal number. Web As long as you are a W2 wage earner and do not have any other businesses andor 1099 income you are can qualify for W2-only income mortgages. Posted on Nov 15.

Web If the transcript is missing because you did not file your taxes most lenders require you to bring your taxes current before you can qualify for a mortgage. More 0 found this answer helpful 0 lawyers agree. Start Today to File Your Return with HR Block.

No Tax Knowledge Needed. Web Yes the tax transcripts can be used for the I-864. Mortgage companies do verify your tax returns to prevent fraudulent loan applications from.

Web Tax Documents are not just for forgetting after April 15th. It will not show the actual W-2 1099s etc but will show the income information the IRS received. Find Your W-2 Online.

Hill Rag Magazine August 2021 By Capital Community News Issuu

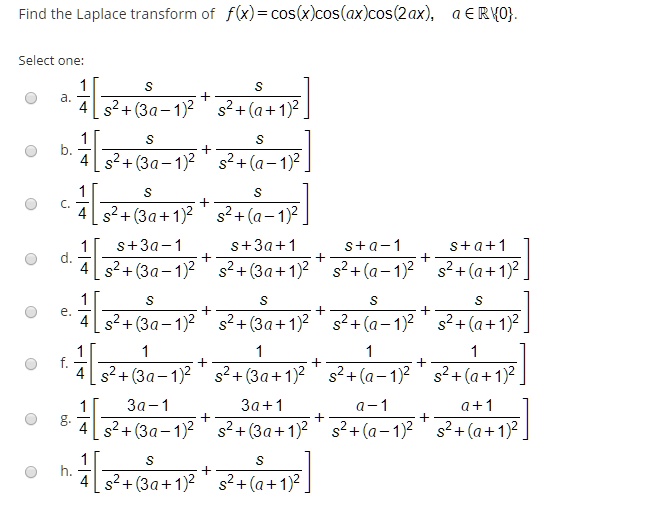

Solved Find The Laplace Transform Of F X Cos X Cos Axcos 2ax A Rko Select One 4z 8a 7 82 A 1 43 73a 132 S2 H Zroa V 32 70 7 2 3a S 30 4 S 0 S 0

Irs Form 4506 Sounds Harmless Enough

Will Mortgage Lender Require The Actual Transcripts Of My Tax Return From Irs Before Approving My Loan Quora

Why Do You Need My Federal Tax Transcripts A N Mortgage

W2 Transcripts Only Mortgagedepot

Irs Form 4506 Sounds Harmless Enough

Will Mortgage Lender Require The Actual Transcripts Of My Tax Return From Irs Before Approving My Loan Quora

Tax Transcripts Affiliated Mortgage

Bulletin Daily Paper 9 27 13 By Western Communications Inc Issuu

W2 Transcripts Only Mortgagedepot

Why Do You Need My Federal Tax Transcripts A N Mortgage

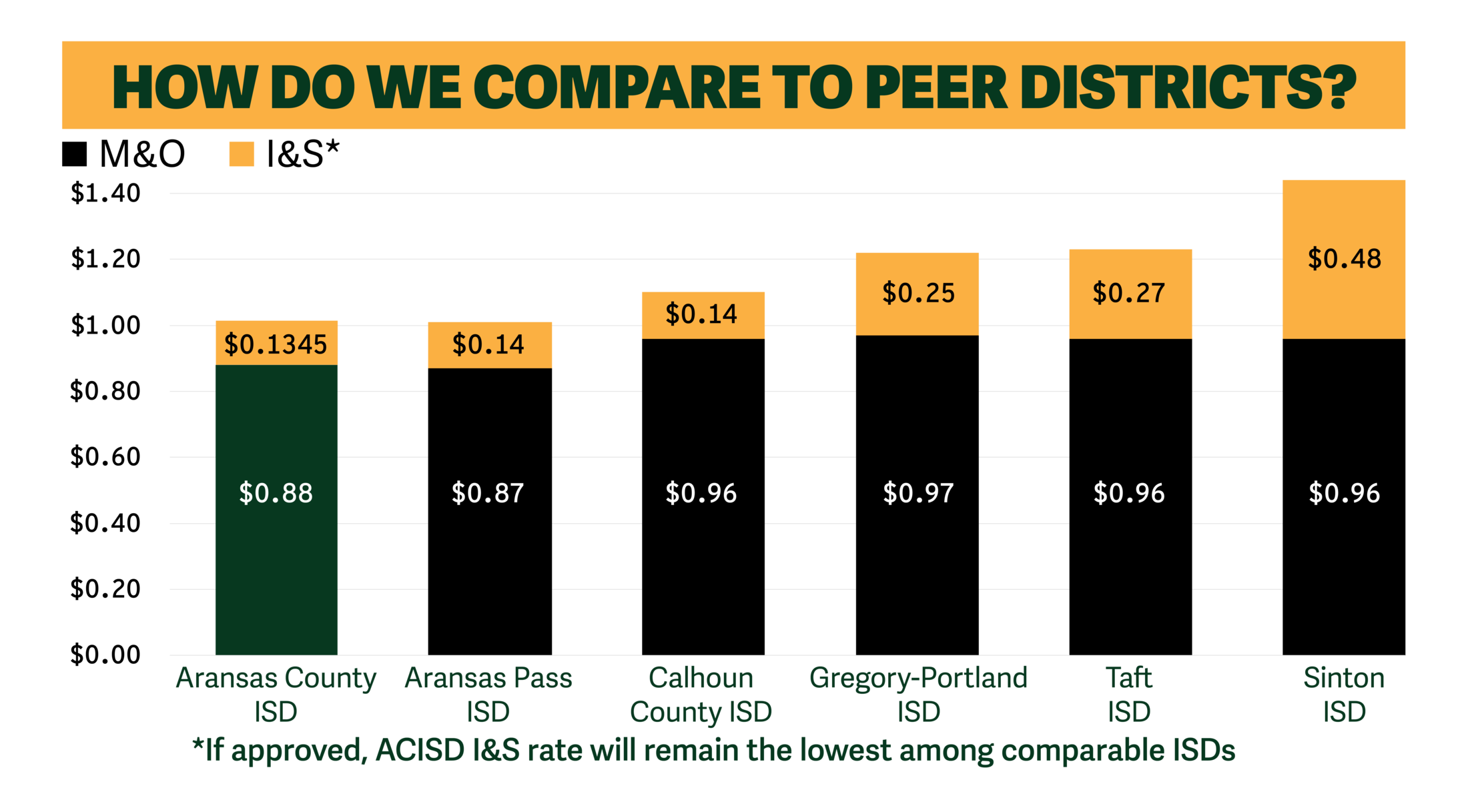

Faq 2022 Bond Aransas Co Independent School District

Why Do You Need My Federal Tax Transcripts A N Mortgage

Irs Tax Transcript For Mortgage

1099 W 2 Get Your Irs Issued W2 1099

Do Not Need Tax Transcripts 1040 S For Fha Va Loans If You Are A W 2 Employee Barclay Butler Financial Inc